SwissBorg Series A

Thank you to our SwissBorg Series A investors! Your incredible participation resulted in record-breaking success!

21.27M

Amount raised (CHF)*

16,660

Investors

1M+

Registered app users

*Aggregated amount collected in the course of 3 concomitant offers to the public and a private sale

SwissBorg Series A

What is the investment potential of this equity fundraise?

Shareholders enjoy returns through price appreciation of their shares and the dividend rights they entail. Exit opportunities include leverage buyouts (LBOs) and public offerings on a listed stock market such as the SIX Swiss Exchange (IPOs).

Generally speaking the earlier the investment, the higher the risk but also reward. A Series A refers to an early fundraising round, usually following a seed-round and prior to subsequent rounds continuing the letters of the alphabet (Series B, C, D and so on).

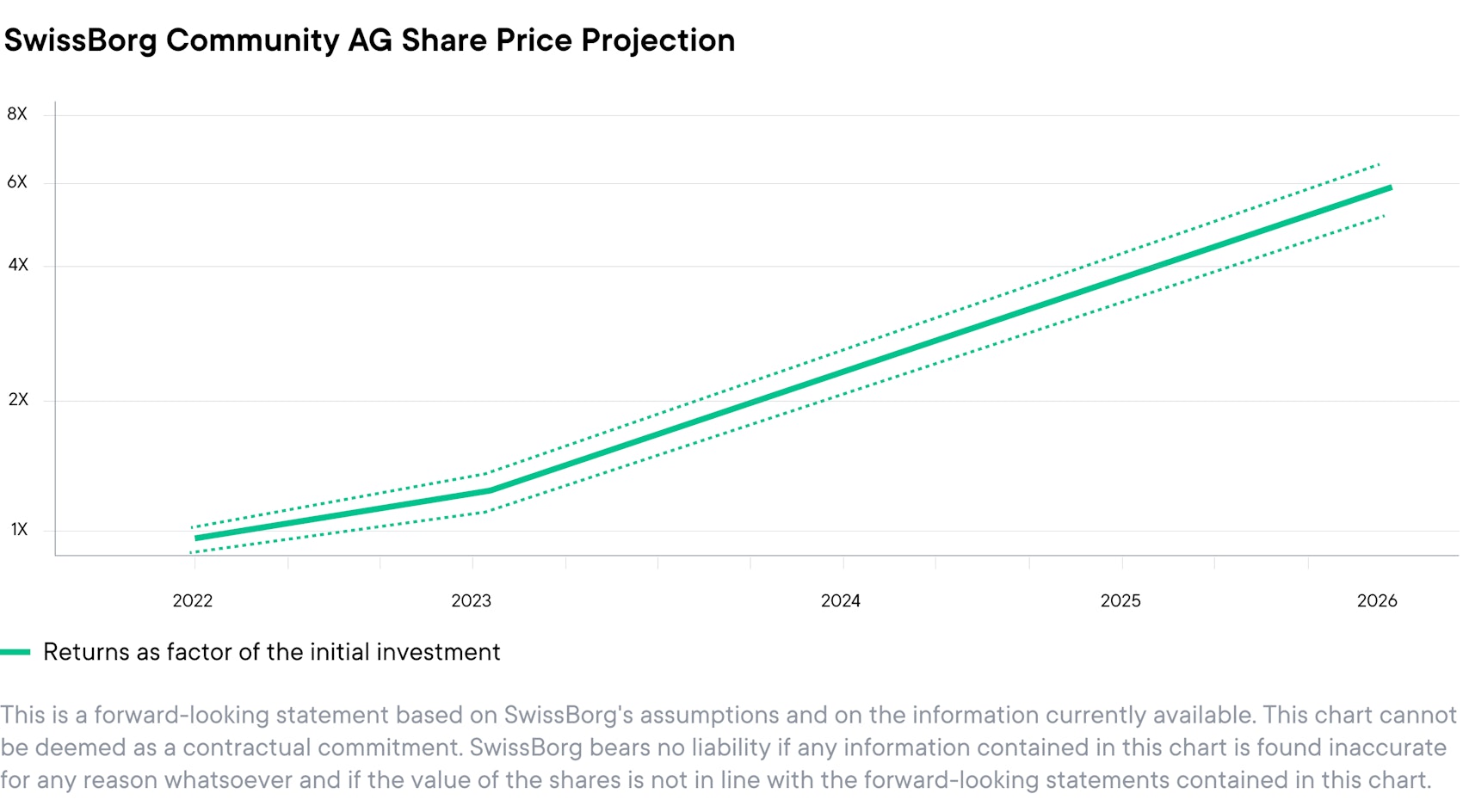

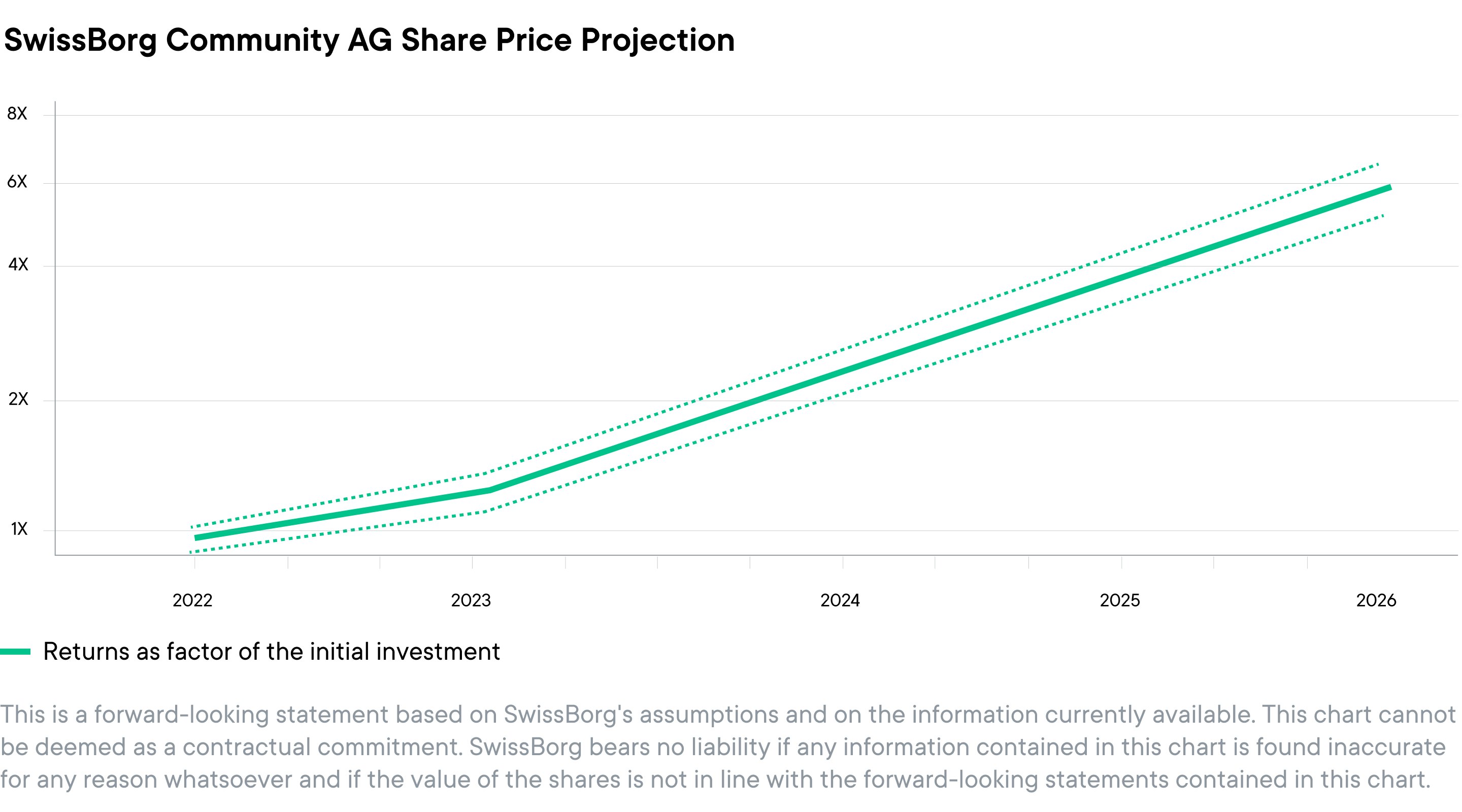

As delineated by the graph above, equity shares follow a higher investment horizon. Its trend correlates fundamentally with the core growth of the company's ecosystem (user base, licences, infrastructure, IP and held assets).

Private markets offer by far the biggest returns in equity, reaching up to high-multiples on initial investments and largely outshining its public stock counter-party. Until now. However, these lucrative opportunities were reserved for institutional and accredited investors. SwissBorg Series A changes this paradigm, democratising the access to equity ownership, directly to the community.

Issuing Price

CHF 1.66

Per ordinary share. Issuer: SwissBorg Community AG.

Subscription Period

Starting Dec. 13, 2022

Until funding limit is reached - legal closing date 31/03/23

Funding Limit

CHF 25M equivalent Regional limits apply. Subject to forex fluctuations.

Regional limits apply

Invest in our Series A in 3 simple steps

- Download the SwissBorg app. If you already have the app, please update it to the latest version.

- Make your deposit and pass your KYC Level 2 by submitting your Proof of Address in the SwissBorg app

- Authenticate yourself through the SwissBorg App to connect to the Launchpad

What am I getting for my investment?

Form of participation

Ordinary shares through an SPV organism

This is an equity fundraise meaning you are buying SwissBorg shares, also called stock, that represents ownership of the underlying company.

Shareholder Structure

Special purpose vehicle entity

The issuer of the shares is a SPV, it is a company formed to undertake a specific business purpose, here, to group all investors in a simple & efficient ownership structure. SPVs are common practice in private equity and do not affect in any way your rights and influence as a shareholder.

Equity Shares and BORG

What is the difference and how will they work together?

BORG tokens

BORG express SwissBorg's value in the on-chain world of Web3.0. They provide utility to existing community members and help attract new ones to join. BORG derives its value from adoption via its utilities and is strongly correlated to market volatility.

Equity Shares

Shares on the other hand, embody the business organisation itself. They grant rights in the legal structure and are a profound investment at the corporate level. Together they become an unstoppable combination capturing the value production of the whole SwissBorg ecosystem - on and off-chain.

The ultimate proof to our community centric values.

How will buying equity shares also benefit BORG?

Equity shares and BORG tokens are complementary investment vehicles - together they encapsulate the full scope of the SwissBorg ecosystem. Here is how the issuance of Series A shares will boost the value of BORG:

Legal Documentation

Please start by choosing the country you reside in to see the relevant documentation to you.

The offer is not subject to a prospectus approved by the AMF, FINMA or the FCA in the sense laid down by Regulation (EU) 2017/1129 (“Prospectus Regulation”), the FinSA or the UK Prospectus Regulation; For French investors, a summary information document, dated from 12-12-2022, was drafted in compliance with AMF’s Instruction DOC-2018-07 and can be found in the Legal Documentation section; The offer constitutes an investment in financial instruments and Investors shall be aware of the following risks : risk of total or partial loss of the invested capital; liquidity risk: the resale of the shares is not guaranteed, it may be uncertain, partial or even impossible; the return on investment depends on SwissBorg’s success as a company; risk of acquiring the securities at a price that may prove too high, particularly due to the absence of their valuation by an independent expert.

The information contained herein does not constitute, directly or indirectly, any form of solicitation or invitation to invest on the offer by the issuer or any of its affiliates

Build the future of wealth with us

We are shaping the future of investment - placing the power back in the hands of individuals.