If you believe in Web3, but are somewhat intimidated by the sheer size of it, you are not alone. As time passes by, the ecosystem is only expanding and the task of managing a portfolio gets more daunting.

Enter Thematics, an easy way to distribute your assets across the entire sector, that is managed by a team of professionals that you know and trust. Let’s take a look at what was going on with our first of many Thematics to be released - the Web3.

Growth

Our Thematics is constantly growing and evolving. With the worst brunt of the crypto winter hopefully behind us, people are now starting to regain the courage to invest in crypto assets again. Because we likely still have some distance to cover before the next bull run, it helps to prepare your portfolio now, with proper diversification and dollar cost averaging.

We have seen some growth in January, both in number of users as well as in the total assets deposited in the Web3 Thematics. Although the latter also changes with the price changes in the markets, there was an overall increase in the Web3 Thematics AUM.

Performance

First, let’s take a look at the performance of the Web3 Thematic, compared to holding individual tokens that make up the bundle. The Last Month column represents the performance in January and as we can observe in the table below, the Web3 Thematic is positioned somewhere in the middle, which is the exact purpose. The goal of Web3 Thematic is to over-perform holding safest assets, while mitigating the downside of holding the risky assets.

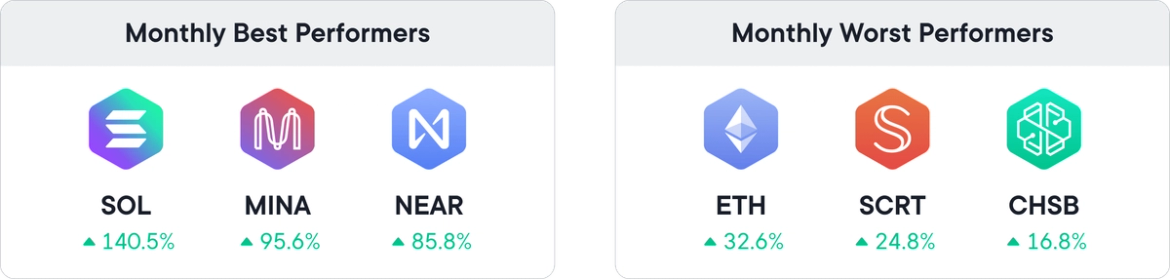

Best & Worst

The following infographic represents the discrepancies between best and worst performing tokens. In a good month, like January, it pays to have some of the riskier assets in your portfolio, so you do not feel like you are missing out. Finding the right balance to be ready for a potential bad month as well is a bit more difficult. Luckily, Web3 Thematics is an easy solution for this.

Long-term comparison

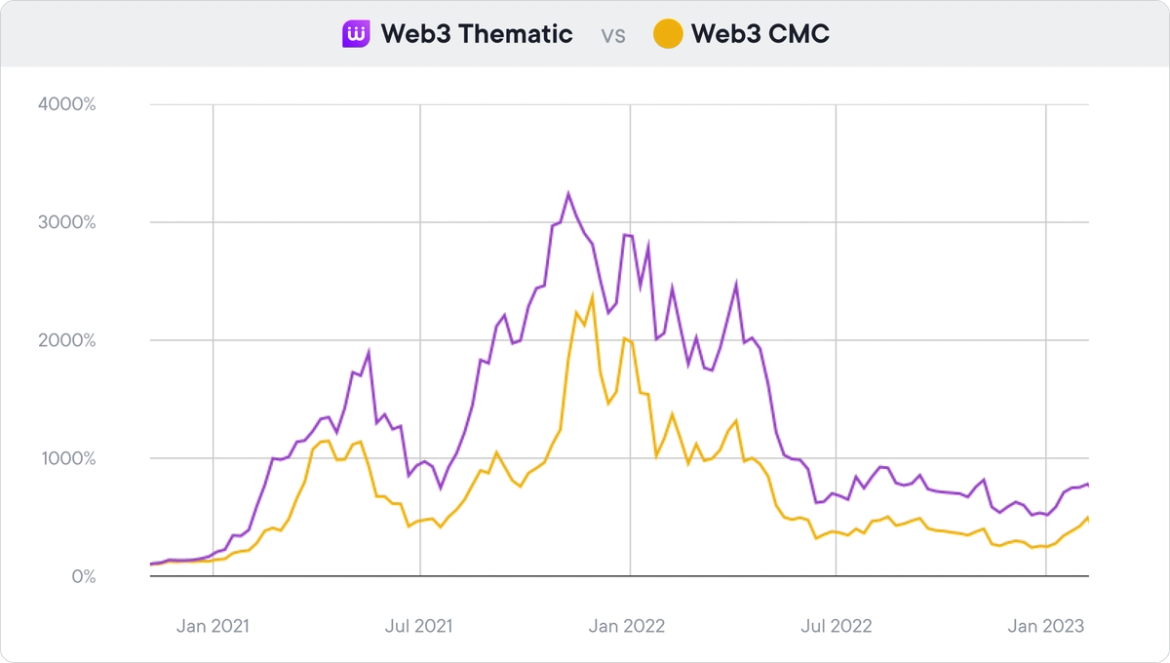

At this point, you might be thinking, okay so I just need to diversify right? How hard can it be? Let’s take a look at the performance comparison between the Web3 Thematic and the Web3 tokens in the top 500 list on Coin Market Cap.

As the chart clearly shows, there is quite a gap between diversifying and smart diversifying. This is where SwissBorg comes in. We are looking at the same tokens as you, but we quantify different metrics and keep track of them regularly. This quantitative approach allows us to find what we believe is the optimal distribution of your assets.

Conclusion

I hope this monthly review helps you understand the added value of Thematics and why it’s important. It’s a product, designed to suit the taste of any investor, big or small. While past performance is in no way indicative of future results, it helps to know that you are not alone in the learning process. That’s why you have SwissBorg.

Own your share of SwissBorg today!