DOT on Curve

Key Takeaways:

- This strategy fits the profile of an investor who is willing to take on a little risk in exchange for a greater reward.

- The strategy is built on the top of Lido and Curve protocols by Beefy, a multi-chain decentralised yield optimizer.

- The strategy is is fairly simple but involves some steps: on the Moonbeam chain, half of the DOT tokens (specifically, xcDOT, the cross-chain version of DOT running on the Moonbeam chain) are swapped into stDOT (Lido staked DOT) and deposited in the Curve pool to provide liquidity to the stDOT/xcDOT pool. All these operations are performed by Beefy. Two tokens and three protocols are involved.

- The Yield (APY) is composed of

- Lido staking on DOT

- Liquidity providing in Curve for the stDOT/xcDOT pool

- Protocol incentives - Because of the number of protocols involved smart contract risk is not to be ignored: exploit in one of the protocols would impact the entire strategy (tech risk).

- Around 1/3 of the Annual Percentage Yield (APY) comes from farming/staking rewards. These rewards are subsidized by the protocol and may not be fully sustainable in the future (yield sustainability risk).

- A lockup period of 90 days is present and rewards are paid out at the end of the period (DOT liquidity risk). For this reason, investors will not be able to quickly adjust to any changes of market conditions.

- Staking and LPing are subject to very specific risks, namely slashing and impermanent loss. Lido is a trustable protocol (low slashing risk) and the fact that stDOT is backed 1:1 by staked xcDOT tokens should ensure that the pair is always trading close to parity (low Impermanent Loss risk).

- Risk Checklist: in our view the predominant risks for this strategy are

- Tech risk

- Sustainability risk

- Complexity risk

- DOT liquidity risk

1. Strategy Explained

The strategy stakes half of the DOT token in Lido Finance in return for stDOT. Then stDOT and xcDOT tokens are deposited in a Curve farm, earning the platform's governance token.

xcDOT is the cross-chain DOT token which is compatible with the ERC-20 standards in active use on Moonbeam. In simple words, xcDOT is Polkadot’s DOT representation on Moonbeam.

Earned token is swapped for more of the underlying assets in order to acquire more of the same liquidity token. The strategy runs on the Moonbeam chain.

Lockup period: 90 days. This is required in order to obey the stake unbonding period of the Polkadot blockchain.

2. Strategy Risks

Trust Score

Beefy Finance is a decentralised, multichain yield optimiser that allows its users to earn compound interest on their crypto holdings. Beefy aims at earning its users the highest APYs with safety and efficiency in mind. The protocol was launched in October 2020. So far it was not subject to any exploit or hack.

SwissBorg trust score for Beefy is ‘green’, i.e. the protocol is trustable. The score value is 7/10 signalling that this protocol (or better, the smart contract on which the strategy is built on) is safe.

Lido is a liquid staking solution for Ethereum. It allows users to deposit their tokens and take part in the Proof-of-Stake consensus mechanism via delegated staking. Currently, Lido supports the liquid staking of ETH, SOL, MATIC, DOT and KSM. In exchange for the provided tokens, the users receive a staked version, e.g. stDOT for xcDOT. These can be used to earn an additional yield in the DeFi universe. Lido launched its staking app on December 19, 2020 with 1 billion LDO tokens created at genesis.

SwissBorg trust score for Lido is ‘green’, i.e. the protocol is trustable. The score value is 8/10 signalling that Lido is one of the safest options out there.

Curve is an automated market maker (AMM) that was developed on the Ethereum blockchain and launched in January 2020.

SwissBorg trust score for Curve is ‘green’, i.e. the protocol is trustable. The score value is 7/10.

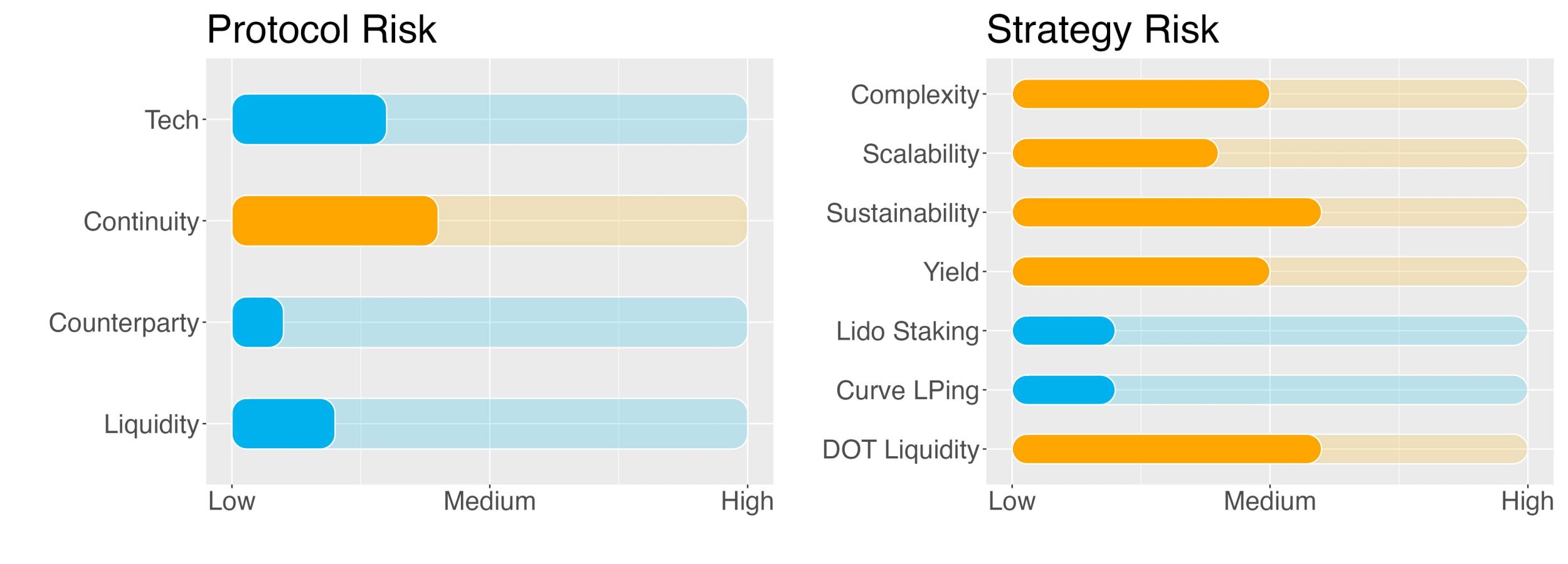

Protocol Risks

Project Continuity Risk

Project continuity risk is medium.

Beefy Finance displays a TVL of around $313m, of which $73m come are locked in the Polygon chain. This puts it in second place in the ‘yield optimizer‘ category in terms of TVL. However, the difference with top DeFi protocols such as AAVE ($4b TVL) or Curve ($5b) is striking.

In terms of valuation the token market capitalization to its TVL is 0.24. A value below 1 means the protocol could be seen as undervalued. Compared to its peers, this figure is below the median of the yield aggregators which is 0.42.

To assess the sentiment around Beefy we look at its token price and volatility, as well as at the Google Trend for the last 30 and 90 days. Overall sentiment is medium.

Beefy continuity risk is 4/10.

Lido is the leading protocol for liquid staking, displaying a staggering TVL of $8.4b (and a ATH of over $20b). In terms of valuation the token market capitalization to its TVL is close to 0, in front of a median for the category of 0.16. Overall sentiment is medium.

Lido continuity risk is 2/10.

Curve Finance is the 4th largest DeFi protocol in terms of TVL with a value of $4.8b. Within its ‘DEX’ category, the exchange sits on the top. Specifically for the Moonbeam network, Curve displays a TVL of $23m.

In terms of valuation the token market capitalization to its TVL is 0.12, in front of a median for the category of 0.94. Overall sentiment is medium.

Curve continuity risk is 4/10.

Counterparty Risk

Counterparty risk is deemed low.

Beefy Finance is a yield aggregator, that is, it provides strategies which help aggregate yield from diverse protocols. Because of this, the protocol has no counterparty risk, except for the tech risk assessed above. There are no borrowing/lending facilities or liquidity provisioning. Counterparty risk could be found in the protocols employed by the Beefy strategy: Lido Finance and Curve.

Lido connects users wanting to stake e.g. DOT with node validators requiring DOT to perform the Proof-of-Stake mechanism. The process is regulated by a smart contact so there is no real counterparty credit risk on the Lido side. For the risk of slashing please refer to the relevant section below.

Curve is an automated market maker (AMM). It is fully decentralised and its operations are all regulated by smart contracts. There is hence no counterparty credit risk when providing liquidity to a pool in the protocol.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

The strategy can be exited at any time from Beefy (although a 90-day lockup applies). However, an additional step is required, i.e. stDOT needs to be swapped back to xcDOT. The stDOT/xcDOT liquidity pool displays a TVL of around $14m so there is plenty of liquidity to perform the conversion.

Liquidity risk is 2/10.

Strategy Risks

Complexity

Complexity of strategy is medium.

The strategy employs one chain (Moonbeam), 3 protocols (Beefy, which leverages on Lido and Curve), and two tokens (xcDOT and stDOT). Because of this the complexity risk of the strategy is deemed medium.

Complexity of the strategy is 5/10.

Scalability

Scalability risk of strategy is low.

Beefy vault liquidity is of around 1m DOT (or $6.8m) and the strategy will be capped at 100k DOT. The risk that the SwissBorg position represents a non-negligible part of this vault is there. However, even with a 10% of TVL entering the pool, the APY dilution is expected to be limited.

Scalability risk of the strategy is 4/10.

Sustainability

Sustainability risk of strategy is medium.

The strategy generates yield via DOT staking in Lido (i.e. taking part in the Polkadot network Proof-of-Stake algorithm) and by providing liquidity to the stDOT/xcDOT pool in Curve (i.e. collecting the trading fees).

Part of the Beefy APY is boosted by Lido. Also, most of Curve APY is paid out in LDO (i.e. Lido) token, i.e. it is fully subsidized. Because of these incentives the sustainability of the offered APY could not be guaranteed in the long term (obviously, if e.g. Curve trading volumes were to increase this would change).

Sustainability risk of the strategy is conservatively set to 6/10.

Yield Risk

Yield risk of strategy is medium.

Over the last month the Beefy vault APY has been constantly floating around a 25% average. The trend since inception is however following a downward trajectory.

Thanks to the protocol incentives (see Sustainability risk above) the strategy yield is expected to be floating around the currently observed levels, albeit constantly decreasing.

The yield risk is hence set to medium.

Yield risk of the strategy is 5/10.

Lido Staking Risks

Lido staking risk is deemed low.

Polkadot is a PoS network, enabling crypto investors to stake DOT in order to contribute to network security and decentralisation and earn an attractive yield for their staked tokens.

Polkadot implements a co-called Nominated Proof-of-Stake (NPoS), a relatively novel and sophisticated mechanism to select the validators who are allowed to participate in its consensus protocol. NPoS encourages DOT holders to participate as nominators. Nominating on Polkadot requires 2 actions: (i) Locking tokens on-chain; (ii) Selecting a set of validators, to whom these locked tokens will automatically be allocated to. Validators who produce a block are rewarded with tokens, and they can share rewards with their nominators. Both validators and nominators can stake their tokens on chain and receive staking rewards at the end of each era.

Two risks are present when staking in Polkadot: slashing and chilling.

Slashing will happen if a validator misbehaves (e.g. goes offline, attacks the network, or runs modified software) in the network. They and their nominators will get slashed by losing a percentage of their bonded/staked DOT. Chilling is the act of stepping back from any nominating or validating. When used as part of a punishment (initiated externally), being chilled carries an implied penalty of being un-nominated.

Liquid staking providers like Lido enable investors to participate indirectly in staking by delegating their tokens to a validator. Validators charge a fee for running a service for delegators. While delegators share rewards with their validators, they also share the risks of slashing. To minimise the risk of slashing, Lido stakes across multiple professional and reputable node operators with heterogeneous setups, with additional mitigation in the form of insurance that is paid from Lido fees.

Slashing risk for the strategy is 2/10.

Curve LPing Risks

LPing risk is deemed low.

The strategy converts part of the xcDOT into stDOT in order to enter the CURVE liquidity pool. stDOT may trade lower or higher than unstaked xcDOT due to demand fluctuation, liquidity issues or technical constraints, exposing you to slippage when entering or exiting an stDOT position (see Liquidity Risk above).

In the event of a heavy depeg of stDOT (could be caused by issues with the Lido smart contracts, Lido DAO security and key management, or a slashing event in which staked xcDOT are lost) the Curve pool would likely be drained out of xcDOT by users swapping stDOT.

In this case the LPer would incur in impermanent loss (IL) since in order to exit the position he will be left with the lower values token.

Additionally, an exploit on the Curve pool could also put pressure on the peg.

These events are more relevant from a tech point of view and these risks have been covered in the Trust Score section.

In terms of IL it is however unlikely that stDOT price deviates substantially from that of xcDOT: one can always unstake the Lido position (though with a 30-day unstaking delay window) and get back xcDOT. There could be a liquidity premium attached to the stDOT value but this will not likely materially impact the peg.

The risk of providing liquidity is 2/10.

Liquidity Risks of staking

Liquidity Risk on staking DOT is medium.

Liquid staking on Lido plus Curve farming requires the investor to lock-up their DOT tokens for a period of 90 days. Regardless of the direction the market chooses during this time, your assets will be out of reach. This aspect needs to be carefully considered when entering this strategy.

Liquidity risk is therefore set to 6/10.

3. Conclusions/Recommendations

Beefy Finance represents an evolution of DeFI being a decentralised, multi-chain yield optimizer platform that allows its users to earn compound interest on their crypto holdings. This is achieved by implementing multi-protocol strategies on behalf of the investor e.g. by automatically claiming daily rewards and investing them back into the strategy.

In terms of the user process, it’s good and smooth, with a helpful interface and a simple enough process to understand, and this removal of confusion is key in our book. When it comes to the ‘real’ APY, the yield currently provided to users comes from staking and LPing fees, as well as from protocol incentives.

The Beefy strategy in DOT comes with some risks. The investment strategy is fairly simple but yet it requires some understanding of how DeFi operates. It does involve a 90-day locking period and rewards are paid out at the end of the period.

The SwissBorg Risk Team ranks DOT on Beefy as a Satellite investment, one for an investor with a medium understanding of DeFi and yielding, who is willing to take on some risk in exchange for an interesting reward on DOT.

Try the SwissBorg Earn today!