In March 2022, Protect & Burn evolved. Instead of buying back and burning tokens, we decided to buy them back and put them in a pool. CHSB token holders were to be invited to vote on how we should spend the pool at the end of each quarter.

In July 2022, based on our first Protect & Choose vote results, we burned 3.45 million CHSB tokens - the largest burn in the history of the token. It was bigger than any of CHSB’s previous 25 burns and over 30% of the total number of CHSB that have been burnt to date!

Since then, the Squads have been building and developing with our community’s best interest at heart. The reality of a market that remains bearish has convinced us of the need for a Bear Market P&C strategy.

P&C bear market strategy explained

With the current macro market conditions, such as Bitcoin underperforming classical assets, inflation, and the general lack of interest in crypto, the strategy to stabilise the price vs Bitcoin with limit order was sustained. Due to the detection of low demand in the market and in the app (see below) no market orders were used. Because of the macro uncertainty in the market, the order book structure and the high correlation with Nasdaq, we adopted a strategy to make sure that we don't fall below critical level vs Bitcoin.

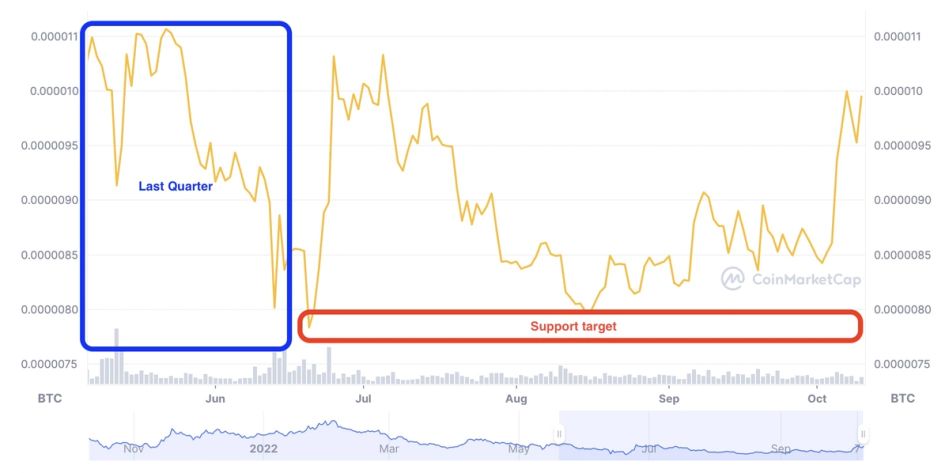

As seen in figure 1.0, the target support order limit was set to 0.0008 BTC at the start of Q2. Given the efforts to stabilise the price of CHSB vs BTC, for the limit order to be triggered, BTC had to reach 0.0008 BTC.

Additionally, as seen in figure 2.0, the net between CHSB bought and sold is trending positive, even though in-app CHSB volume has been lower this quarter, as expected. However, given market conditions, the positive pressure is marginal.

Despite the marginal impact of the positive buying pressure, once and if the target support price of BTC is triggered, a limit order triggered will follow soon after. This means that because we haven’t entered a bearish enough zone relative to BTC, the standard buy-back and a voting mechanism did not occur.

CHSB has shown strength against BTC in this very uncertain market where there’s also a marked lack of demand. This leads us to be very positive about the future and see a potential bottom formed vs BTC. Thus, the pool has been kept untouched and is available for the future (see below).

For now, the strategy in place is the same for the beginning of the next quarter: protect the price of CHSB vs Bitcoin with limit orders. However, if the overall market gives us a trend reversal or de-correlation, these orders could be raised with an increase in demand.

Furthermore, we believe, products and adoption will significantly increase demand (themes, new vault earns, investment facilities and virality). Price support, and the use of market order or higher limit orders will therefore be used to support the price.

Our top priority is to increase the demand for CHSB by launching innovative products that respond to the demands of our community, and industry at large. The launch of SwissBorg Earn was just the start, Thematics is around the corner, with what’s in store by the end of the year, it’s time to keep calm, build & hodl on.

Increasing the demand for CHSB by launching innovative products is our priority. We build products that respond to the demands and desires of our community and the digital asset space as they both evolve. Premium Tiers expansion and SwissBorg Earn were just the beginning.

Thematics is nearing launch. With it we introduce our pioneering crypto bundles, where CHSB will have its rightful place. This first-of-its-kind product’s potential impact on the price of our token we’ll let you calculate for yourself. We are confident that SwissBorg and our token, the CHSB, are well-positioned to not only face the future but to rise with it.

Invest in CHSB today with the SwissBorg app