Introducing our Glowing Golden Crypto Bundle!

Regardless of your risk profile, everybody should have some Gold & some Bitcoin in their portfolio; the Golden crypto bundle is one of the best wealth management products we have built so far.

Cyrus Fazel, proud founder & CEO of SwissBorg

The power of Bitcoin, the resilience of Gold, on autopilot.

The Golden Crypto Bundle combines the full potential of Bitcoin with the timeless value of Gold to create an unshakeable foundation for your financial goals. It's time to treat your hard-earned money right by placing it in the most prominent store-of-value assets on earth. Watch your investment be automatically optimised as the market changes.

Discover how the Golden Crypto Bundle can become the rock-solid foundation for your financial goals.

Try it out now to benefit from 0% Subscription Fees until the end of September! 🤯

Discover the SwissBorg Golden Crypto Bundle today!

The Golden Crypto Bundle in a nutshell

The Golden Crypto Bundle is more than just an investment in Bitcoin and Gold. It's a fully automated product that intelligently trades between these two assets based on market changes. This is possible because it understands the unique market behaviours of both assets.

Bitcoin, an emerging asset, is known for its high volatility. This means it can soar when the market is strong, but it can also plummet, sometimes losing up to 85% of its value when the market weakens.

On the other hand, gold is a time-tested asset that has maintained its value over centuries. It is known for its stability and its ability to preserve wealth during market downturns.

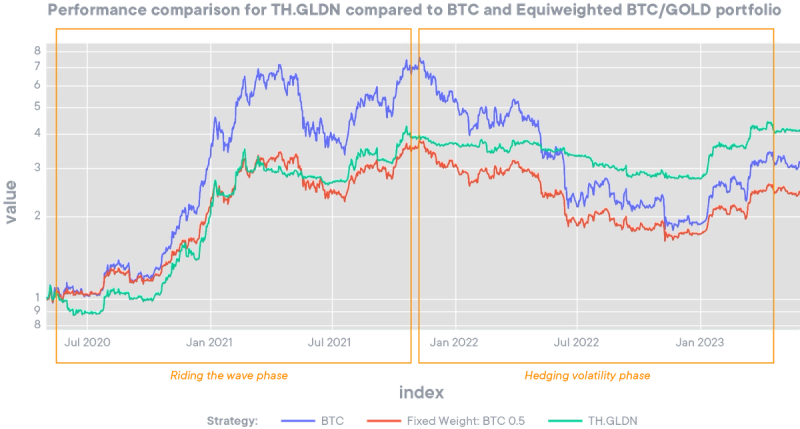

The Golden Crypto Bundle leverages these characteristics. When the market is on the rise, it overweights Bitcoin Allocation to capture its growth potential. But when the market shows signs of overheating or heading for a downturn, it automatically shifts your investment towards Gold to protect your wealth and capital.

This entire process is fully automated by SwissBorg's proprietary Golden algorithm, allowing you to navigate the crypto market cycles like never before.

The Golden Crypto Bundle is designed to truly make your money shine.

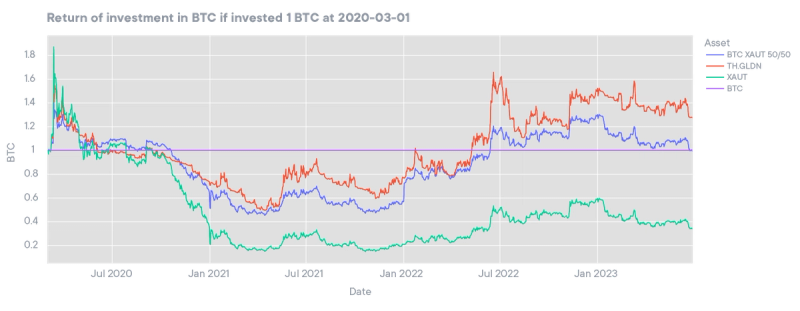

Although history doesn't exactly repeat itself, it often presents similar patterns. Consider how much Bitcoin you could have accumulated if you had invested in the Golden Crypto Bundle during the last market cycle. The Golden Crypto Bundle is engineered to align with Bitcoin during its strong upward trends, and to protect against Bitcoin's downturns by shifting towards the less volatile Gold. This strategy can potentially lead to better performance than Bitcoin alone as market cycles progress.

What is the Golden Crypto Bundle's added value?

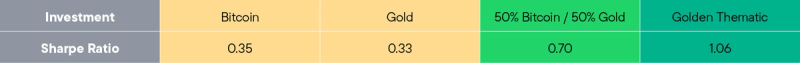

Best-in-class risk-adjusted returns

In finance, an investment’s SHARPE ratio helps you understand the return potential of an investment compared to its risk. For example, at an amusement park, the SHARPE ratio would tell you which roller coaster gives you the most fun (return) for the level of scariness (risk) you must endure. The higher the Sharpe Ratio, the more return you are getting for the level of risk you're taking.

Here are some relevant Sharpe ratios to compare:

In simple terms, the Golden Crypto Bundle allows you to capture the market's upside with Bitcoin while protecting against its volatility and drawbacks using Gold. Volatility often leads to emotional investment decisions, like selling in a panic at the bottom or jumping into overpriced assets out of fear of missing out. These emotional decisions most often result in losses.

Why invest in the Golden Crypto Bundle?

The Golden Crypto Bundle can serve as the basis of your portfolio; here is why:

- A “real” savings account: Saving means sacrificing instant gratification to achieve more significant financial goals in the future. Yet saving in Euro, Pounds & Francs is like building a house with straw and sticks. Very quickly, your house starts to degrade and becomes a liability that works against you. Your savings in your bank account are no different. 70 years ago, our grandparents could buy 20 Coca-Cola bottles for $1. Today, that same amount doesn’t even get you a single 0.5l bottle. It’s time to make your hard-earned money work for you. It’s time to leave the straws and sticks behind and build your financial fortress on rock-solid assets. The Golden Crypto Bundle combines the most renowned store-of-value assets on Earth: Gold and Bitcoin. Leveraging their unique market behaviour differences rewards your efforts to save today by appreciating your wealth tomorrow.

- It’s the ultimate way to enter the Market: Combine the Golden Crypto Bundle with the might of SwissBorg’s Auto-invest and watch yourself become one with the market. When you blend Auto-Invest’s ease to dollar-cost-average into the market with Golden Crypto Bundle's unique market-driven algorithm, your investment unlocks the full power of SwissBorg. DCA into a bullish market and captures the full potential of Bitcoin, DCA into a bearish market and the Golden Crypto Bundle automatically hedges your investment with Gold converting it to Bitcoin once positive momentum is back.

With the Golden Crypto Bundle and Auto-Invest, you can forget about trying to time the market; you are the market!

- It’s a better Take-Profit exit for traders: Avoid selling a token for a stablecoin only to see your token continuing to rise after you sold. You feel left on the sidelines, upset by the profits you are leaving on the table. You decide to reinvest finally, only you do it too late and end up riding the token back down. Instead, exit trades into the Golden Crypto Bundle and avoid the FOMO altogether since it continues to ride the market upwards and automatically hedges as it goes back down. Don’t FOMO into overpriced assets; take profit with the Golden Crypto Bundle!

- It’s the smart way to stack sats: Do you count your wealth in Bitcoin? The Golden Crypto Bundle is designed to help you accumulate more Bitcoin throughout market cycles. Using the relative stability of Gold, as bull and bear markets unfold, the Golden Crypto Bundle allows investors to potentially outperform Bitcoin and accumulate more satoshis. Active investors might want to time the bear market, but attempt that at your own risk if you don’t have a crystal ball ;)

The unique approach of the Golden Crypto Bundle towards adding real investment intelligence and automated execution towards two complementary assets, such as Bitcoin & Gold, is what truly sets it apart from any product on the market.

At SwissBorg, the future is bright, now with the Golden Crypto Bundle, it is also glowing!

Let’s dive Deeper

How does the Golden Crypto Bundle work?

Its Logic:

The Golden Crypto Bundle stands out because it is an ingenious wealth management product with a proprietary algorithm crafted by SwissBorg's investment team. This algorithm takes into account the volatility differences between Tether Gold and Bitcoin to make intelligent allocation decisions.

The Golden Genius Algorithm works by using standard rolling RSI indicators to identify different market conditions, such as a Bull Market, Correcting Market, Bear Market, or Accumulating Market. These conditions signal a macro "Market Change."

Based on the type of Market regime, the algorithm adjusts the investment allocations. Over the last 3 years, the Golden Algorithm performed, on average, 15 to 20 reallocations per annum. Whilst allocations draw on macro changes, they can also occur within smaller timeframes. Typically, during bearish or correcting market conditions, it will lean, on average, towards Gold. Conversely, during bullish or accumulating market conditions, it favours Bitcoin. The algorithm caps any asset allocation at 85% and lets asset-drift occur freely to capture their full momentum.

Typical assets Rebalancings are thus not applicable here, and allocations can effectively extend to 95% in one asset.

The real magic happens when a new signal is triggered. The Golden algorithm springs into action, triggering reallocations based on the new market conditions. This ensures that your investment is always optimally positioned, no matter what the market is doing. The SwissBorg investment team may add its own intelligence to the Golden Algorithm in case of looming black swan events or non-quantifiable risk factors.

Its Mechanics:�

Unlike the Web3, our future-facing and conviction-based Crypto Bundle, the main risk factor for the Golden Crypto Bundle is not the assets it holds but the market itself. This means Reallocations are much more time sensitive, particularly when the market is highly volatile. One simply can not wait a week for their turn to be reallocated. The SwissBorg engineering team has thus implemented some critical changes to reallocate all Golden Crypto Bundle investors in the shortest delays possible using the Smart Engine’s maximum execution rate.

If you are a Web3 Crypto Bundle investor, you will be familiar with Rebalancings & Reallocations occurring on a recurrent basis (monthly for Web3), depending on the moment of your first purchase. If you bought on the 15/02 at 2 pm you will always get rebalanced/reallocated on the 15th of the month at 2 pm.

With the Golden Crypto Bundle, this is drastically different. The concept of a recurring queue does not exist. Instead, once the Golden Algorithm has broadcasted a new signal, all Golden investors are immediately placed in a random queue formed acutely, and our Smart Engine executes each reallocation at its maximum capacity. Once the last investor has been placed on the new allocation, the queue dissolves until the next signal. We currently anticipate being able to reallocate 10 '000 investors within a 6-hour span from the signal being broadcasted. A mindblowing achievement. Plus, as we continue to optimise our technology, we envision to keep improving our throughput rate, minimising further queue times.

A point on the fees:

We are delighted to be able to offer the Golden Crypto Bundle on our special Golden Summer promotion with 0% subscription fees until September 30th, 2023. During this time, we are working hard with our finance team to propose an improved fee structure seeking to provide more value to our users. Our goal with a flagship product like Crypto Bundles is to make it a source of growth for SwissBorg across the financial space. No product like it exists today.

This backetest showcases the dynamic capacity of the Golden Crypto Bundle to adapt to different market regimes. During bullish Bitcoin price movements the Golden Crypto Bundle is able to “ride the wave” and present a strong correlation to Bitcoin. As the market turns and shifts downwards the Golden Crypto Bundle breaks that corollary, significantly over performing Bitcoin with hedging itself in Gold to minimise drawdowns.

Now let’s look at its assets

So, Why Bitcoin?

Bitcoin represents a digital evolution to Gold. It shares the core characteristics of scarcity, fungibility, and durability yet offers groundbreaking improvements. Bitcoin's supply is absolute; 21 million coins and not one more, secured by millions of validating nodes around the world. Moreover, it's easier to transport, divide and safely store than physical Gold. Bitcoin is the ultimate Store of value for the digital world; why institutional adoption is ramping up, its future looks, indeed… golden.

Why Gold?

Gold, on the other hand, has stood the test of time as a reliable store of value for centuries. Its scarcity, physical properties, and universal acceptance have made it the longest-standing form of money since the time of the Pharaohs. Gold has traditionally served as a hedge against inflation and economic downturns, maintaining its purchasing power even in challenging times.

Why XAUt as Gold?

To provide access to Gold, the Golden Crypto Bundle uses Tether Gold, a tokenized IOU (I owe you) of physical gold. Tether Gold (XAUt) is a digital token fully backed by physical gold. It provides fully redeemable ownership of real physical gold. Each individual XAUt token represents 1 troy ounce of London Good Delivery gold held in a vault in Switzerland.

Aside from its proximity to our Swiss values, we have chosen XAUt as our preferred representation of Gold for several key reasons. The choice had to be made between XAUt and other established options, such as PAXG. Compared to PAXG, XAUt has a very similar market cap with good liquidity provision with Bitfinex, one of our closest exchange partners used by our Smart Engine. SwissBorg has a privileged line of communication with the Bitfinex and Tether teams, wherein our Treasury experts are capable of directly anticipating & addressing the liquidity provision of XAUt tokens. Additionally, Bitfinex does not apply any throttling through their FIX (Financial Information Exchange) API architecture. Throttling refers to limiting the number of transactions or data requests that can be made within a certain period. Not being subject to throttling enables SwissBorg to confidently fulfil all reallocations of our users at the maximal rate of execution - a critical aspect for the market-driven nature of the Golden Crypto Bundle. XAUt is also exempt from any custody fees and gas fees charged by Tether. A value proposition SwissBorg passes in its entirety to all Golden Crypto Bundle investors.

By contrast, Paxos, the company behind PAXG, is currently facing a heightened amount of uncertainty due to their close ties to Binance, which is pursued by the SEC in the USA. With all PAXG volume residing on Binance, SwissBorg chose to avoid being exposed to their strong throttling limitations for the Golden Crypto Bundle, given that all its reallocations occur within the smallest time frame possible. Golden Crypto Bundle users will thereby also avoid the 0,02% transfer fees charged on all PAXG exchanges.

XAUt has a better risk & liquidity profile as of today.

Nicolas Rémond, SwissBorg CTO

The final remarks

In a world where the value of traditional money is constantly eroding, there is no time to sit back; it's time to take a stand. It's time to build your financial fortress with the right materials. It's time to invest in the Golden Crypto Bundle.

The Golden Crypto Bundle is more than just a product; it's a commitment to your financial future. It's a commitment to making sure your money is always working for you, no matter what the market is doing. It's a commitment to building a financial fortress that can withstand any storm.

So, are you ready to take control of your financial future? Are you ready to build your financial fortress with the Golden Crypto Bundle?

Discover in the Golden Crypto Bundle today and benefit from 0% subscription fees until the end of September!

Let your money shine. Let your future glow.

Try SwissBorg Golden Crypto Bundle today!