SwissBorg Earn: How to Unlock Exponential Yield on Your Crypto

Franklin Lacroix

Director of Investment Success

Introduction

In traditional finance, earning interest usually means parking your money in a savings account and watching it grow very slowly. Crypto flips that equation: you’re not just earning a higher yield, you’re earning yield on a growing asset. Many investors overlook this paradigm shift.

Here’s the kicker: when a crypto asset appreciates over time, your earned yield appreciates with it. The result isn’t just compounding in the traditional sense but exponential upside. Imagine earning 6% in ETH back when it was $200; that yield is now worth many multiples more.

The real power of SwissBorg Earn is positioning yourself in your favourite yielding token and placing it in Earn for long-term exponential growth, passively.

The Core Thesis: Yield + Appreciation = Wealth

SwissBorg Earn allows you to generate interest directly in the crypto you believe in. Unlike earning in fiat, where your gains are tied to a stable value, Earn lets you grow your position in an appreciating asset.

Let’s say you earn 5% APY on 1 ETH. After one year, you’ll have 1.05 ETH. If ETH appreciates from $2,000 to $3,500 during that period, your yield has effectively increased by 75% in dollar terms, without you lifting a finger.

This is the exponential effect:

- You’re compounding crypto units

- The asset itself may increase in value

- You benefit from two layers of upside, not just one

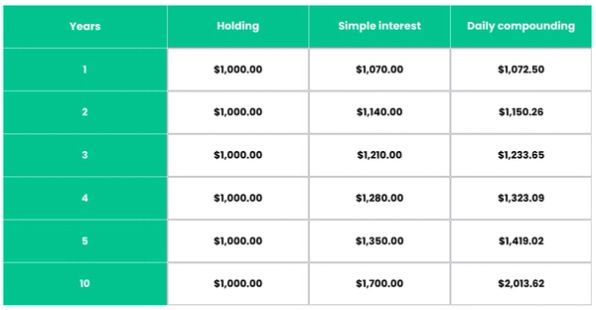

Assuming a 7% annual yield (the current rate on Solana for Generation Premium).

See how daily compounding transforms returns: over five years, your total value can be about 40% higher than simply holding Solana.

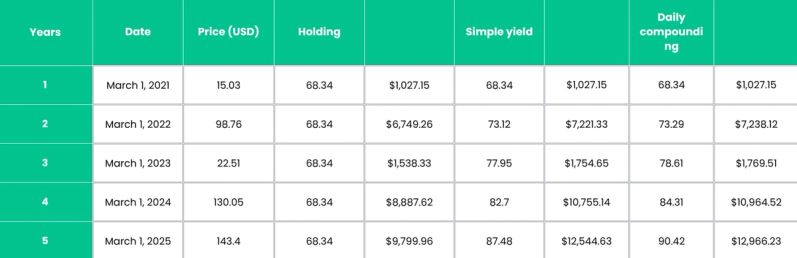

Now, combine compounding yield with asset price growth: since Solana rose 8.5x over the past five years, staking in Earn would have boosted your holdings to roughly 11.6x.

Over time, this transforms passive holding into intelligent compounding. And if you’re already holding the asset, activating Earn is simply unlocking what’s already possible.

How SwissBorg Earn Works

SwissBorg Earn is designed to make yield generation simple, transparent, and secure - even in the complex world of crypto finance. Each Earn strategy is carefully designed by our expert investment team. Simply choose the option that matches your risk level, and let your assets grow over time.

What sets it apart:

- Mostly no lockups: Most strategies are flexible. You can enter or exit at your convenience, with only a short cooldown period sometimes.

- Daily yield accrual: Your assets work for you every day. Your rewards are updated daily and reflected in your balance.

- Earning in kind: You earn in the same asset you deposit. Deposit ETH, earn ETH. This is key to the exponential upside.

- Secure by design: Assets are deployed through audited, battle-tested protocols with constant monitoring and multi-layer security.

From a user’s perspective, the process couldn’t be more straightforward:

1. Hold a supported asset in your SwissBorg account

2. Tap “Activate Earn”

3. Start earning yield as early as the next day

SwissBorg Earn bridges passive investing and innovative, long-term compounding in crypto.

A common question investors have is: "If my crypto is earning, can I still access it when I need it?" The answer with SwissBorg Earn is: almost always, yes.

Most Earn strategies are designed with maximum flexibility, allowing users to exit whenever they like. However, some strategies include a cooldown period, typically 24 to 72 hours to a few weeks, before funds are fully available for withdrawal.

The cooldown period in SwissBorg Earn isn’t a flaw—it’s an essential feature that enables yield to be generated efficiently and sustainably:

- It ensures operational stability and proper settlement of yield positions

- It protects strategies from forced unwinding during sudden exits

- It enables higher, more consistent yield by reducing volatility

In most cases, this delay comes from the protocol level itself. Many Proof-of-Stake (PoS) blockchains, like Ethereum or Solana, impose native cooldown or unbonding periods when unstaking assets. SwissBorg simply aligns with these blockchain rules to deliver secure and reliable yield.

Think of it like a short runway: your assets are still yours, just temporarily in transit as they rebalance back to liquidity. For most users, this minor delay is a fair trade-off for smarter, higher-yielding strategies.

SwissBorg is always transparent about which strategies involve a cooldown, and you'll be informed before activating Earn. The trade-off is clear: a short wait in exchange for real, sustainable yield.

Our Risk Framework

The Three-Tier Risk Framework in SwissBorg Earn

To help investors navigate the varying risk and reward profiles of different yield strategies, SwissBorg Earn employs a simplified three-tier risk classification: Low, Medium, and High. This framework aims to provide a clear and straightforward way for users to understand the potential risks associated with each Earn opportunity and align their choices with their personal risk tolerance and financial goals.

This system categorises strategies based on their underlying mechanisms:

- Low Risk: Primarily encompasses staking strategies for Proof-of-Stake (PoS) cryptocurrencies. Example: Native Staking (ETH, SOL, etc.)

- Medium Risk: Typically involves standard DeFi yield strategies, such as lending on established protocols or providing liquidity, where leverage is not a primary component. Example: Lending (Aave, Compound), Stablecoin Yield (Stargate - non-leveraged), tBTC on Morpho

- High Risk: Characterised by more complex or aggressive strategies, including those that utilise looping (repeatedly borrowing and lending/staking an asset to amplify yield) or leverage, or interact with newer, less battle-tested DeFi protocols. Example: Leveraged Staking (ETH Hyperloop), Advanced DeFi strategies

Maximising Your Wealth Potential

The real strength of SwissBorg Earn is its alignment with long-term wealth-building strategies. For most investors, the ideal approach isn't choosing between HODLing or earning - it's combining both.

By activating Earn on the assets you already plan to hold, you put your portfolio to work while maintaining exposure to upside. Over time, this compounds both your crypto holdings and their dollar value.

Here’s how to make the most of it:

- Stay invested: The longer your assets remain in Earn, the more compounding works in your favour.

- Diversify yield: mix different Earn strategies to adapt returns and risk to your profile.

- Reinvest consistently: Consider setting up recurring buys paired with Earn activation for automated dollar-cost averaging into yield-bearing assets.

Why SwissBorg Earn Stands Out

There are many yield platforms in the crypto space, but few combine user experience, transparency, and institutional-grade strategy design like SwissBorg. Here's how it compares:

Earning in kind: You earn more of the asset you believe in

Transparency: Know exactly how your yield is generated

Security: Battle-tested protocols, multi-layer monitoring

Flexibility: Enter and exit strategies with ease

Unlike shadowy CeFi platforms that collapsed in 2022, SwissBorg prioritises transparency and control. You remain in charge of your assets while benefiting from institutional-level investment logic.

Frequently Asked Questions (FAQ)

Q: Can I lose money in Earn?

A: While SwissBorg employs strict risk controls, yield generation in crypto carries inherent risk. That said, strategies are designed to prioritise capital preservation.

Q: What happens during the cooldown?

A: Your funds are still yours, just temporarily in a transition phase before becoming fully liquid again. No yield is lost.

Q: How often is interest paid?

A: Daily. Your yield is updated every day and reflected directly in your balance.

Q: Is Earn available for all assets?

A: No, only selected assets have a live strategy. But if you hold one of them, you’ll be prompted to activate it when eligible.

Q: Can I compound my rewards?

A: Yes. All rewards are automatically added to your Earn balance, making compounding seamless.

Conclusion

In essence, SwissBorg Earn is not merely an opportunity to generate yield, but a comprehensive tool designed to optimise crypto holdings and realise the full potential of exponential growth within the crypto ecosystem. It encourages a holistic approach to investment, where holding and earning are not mutually exclusive but rather synergistic forces driving long-term wealth creation.

Explore SwissBorg Earn and put your crypto to work.