Crypto Bundles: Why SwissBorg offers a trend-following algorithm

Xris Diserens

Chief Wealth Officer

Since the rebranding and adjustment of our Thematics to Crypto Bundles we have witnessed some confusion among our community of app users. With this article, we hope to clarify the reasons behind the evolution of our strategy and why we made the shift from a fundamental analysis approach to a trend-following approach.

What is the Big Difference Between the Previous allocation and this one?

When the thematic baskets were first launched, we adopted a fundamental analysis approach for token selection. This method evaluated tokens based on their intrinsic value, technological potential, and long-term viability. While this strategy has worked in many instances, it often overlooks the community-driven nature and trending effects that significantly impact the crypto market. For example, tokens like Ethereum and Avalanche have robust technology and proven track records, but their performance in 2024 has been relatively underwhelming compared to other tokens.

After analysing the historical performance of the cryptocurrency market, we concluded that a trend-following allocation would be better suited to optimise returns. This allocation focuses on identifying and capitalising on upward market trends and aligning investments with those trends. Tokens like Solana and Mantra, which have demonstrated exceptional performance, are prime examples of how a trend-following approach can deliver more consistent results. As the saying goes, "The trend is your friend."

What is a Trend-Following allocation?

A trend-following allocation focuses on identifying the direction of market trends and aligning investments with those trends. It relies on an algorithm that uses quantitative models that consider objective factors such as market capitalisation, past performance, and liquidity, while also leveraging technical indicators like Moving Averages and Relative Strength Index (RSI) to determine optimal entry and exit points. At SwissBorg, Crypto Bundles are built using a proprietary algorithm relying on a benchmark methodology that integrates these momentum-driven metrics to maximise returns. Allocation changes are driven by the algorithm, based on objective and quantitative metrics, pre-defined by SwissBorg. SwissBorg does not provide daily management of users’ assets but merely designs the algorithm.

Why We Chose the Trend-Following Allocation

Market Efficiency Hypothesis:

The trend-following allocation is grounded in the widely accepted financial principle that price reflects all known information (some would also say that it includes unpublic information). In the cryptocurrency market, where sentiment and momentum play a significant role, this principle holds true. Price movements often provide a reliable signal for predicting future performance. By focusing on trends, we can quickly integrate new information, such as news or changes in community activity.

Adaptability to Crypto Volatility

Cryptocurrencies are highly volatile and driven by short-term trends. A trend-following approach allows for optimisation of the composition of a Crypto Bundle more frequently, ensuring capitalisation on emerging opportunities while minimising exposure to underperforming assets. This adaptability is essential in a market as fast-paced as crypto.

Proven Success in Crypto

Historical data shows that crypto markets often experience prolonged trends. By focusing on upward trends, investments are aligned with tokens gaining momentum and positions are adjusted accordingly. As we know, sometimes it's better to let a winning position ride until it reaches exhaustion, rather than constantly switching positions.

Time Frame and Reallocation Frequency

A critical component of implementing a trend-following allocation is determining the appropriate time frame for capturing trends. After careful consideration, we've decided to increase the reallocation frequency to once a month, with the potential to increase it even further. This adjustment will help us capture shorter-term market movements and stay agile in a rapidly changing environment.

To support this, we've also refined the token selection criteria, placing a stronger emphasis on liquidity. This ensures we can quickly buy and sell tokens without significantly impacting their prices.

Performance Measurement and Benchmarking

To measure the effectiveness of the trend-following approach, we compare the performance of our Crypto Bundles against an equally weighted portfolio of tokens within the same universe. It’s important to note that the SwissBorg universe —rather than platforms like CoinMarketCap, for example— represents a more restricted and challenging benchmark, as we curate and list only the tokens that meet our stringent criteria.

Application on the Best Blockchains Bundle

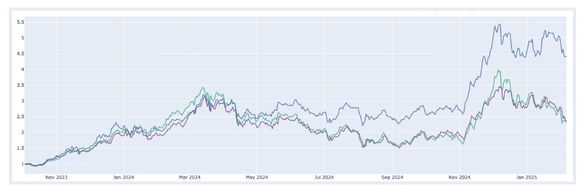

In blue, you have the backtest of the Trend Following Algorithm Bundle. The new model is live since the last reallocation, which took place in early February.

In green, you have the theoretical equally weighted bundle that serves as the benchmark.

In purple, you have the actual performance of the Best Blockchains Bundle based on fundamental analysis.

Conclusion

SwissBorg’s shift from fundamental analysis to a trend-following strategy ensures a more dynamic and adaptive approach to crypto investing. By leveraging market momentum, technical indicators, and monthly reallocation, we can capture opportunities faster while reducing exposure to underperforming assets.

This change reflects our commitment to optimising returns, enhancing flexibility, and aligning with the fast-moving nature of crypto markets. As the industry evolves, we’ll continue refining our strategies to empower our community with smarter, data-driven investment solutions.

Share your feedback about our new reallocation approach