The next chapter of Better than CEX is here - Become a Market Maker

Anthony Lesoismier

CSO & Co-founder

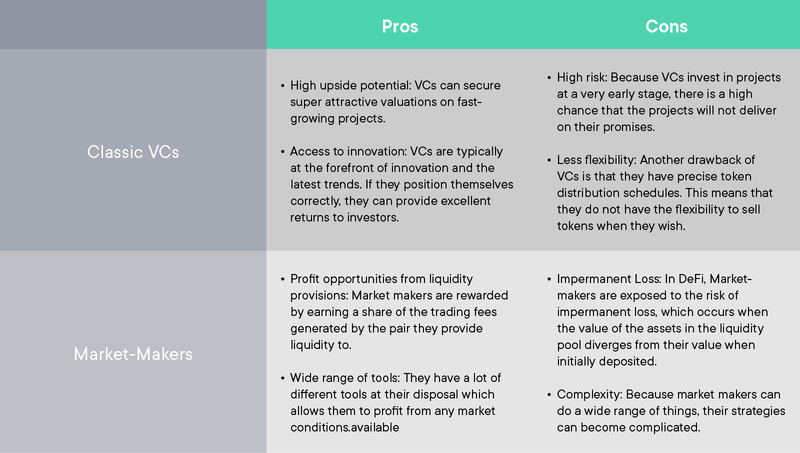

Let’s face it. In crypto, the people who make the most money are VC investors and market-makers. Each has a particular edge in the market, and these are their main trade-offs:

At SwissBorg, we are driven by a strong commitment to giving our community access to exclusive investment opportunities with the same terms as professional investors. This is why we have carefully crafted our Alpha Opportunities to allow our community to invest in early-stage projects in the same way that VCs secure their deals. We consider this our way of redistributing the power dynamics of our community.

However, we believe that we can go a step further in our Alpha Opportunity journey. We are proud to introduce a new kind of vault at the intersection of classic VC-style investing and Market Making. This one-of-its-kind design aims to secure the most attractive deal terms for our community.

To understand this new vault design, let us quickly examine what constitutes Market-Making.

An Overview of Market Making

The most fundamental aspect of a well-functioning market is giving traders and investors a reliable price and the ability to buy and sell their assets quickly. This is the role of Market Makers.

However, in DeFi (Decentralised Finance), market-making is not conducted in the traditional way, as there are generally no order books. Instead, one of the most popular DeFi market-making tools is AMM (Automated Market Maker), which uses liquidity pools.

Let’s take a glance at how liquidity pools and AMM work.

Liquidity Pools & AMM

In standard AMM models, liquidity providers (LP) deposit assets into liquidity pools for the two assets for which they wish to provide liquidity. The price of the assets is then determined by an algorithm that takes into account the ratio of the token pairs within the entire pool.

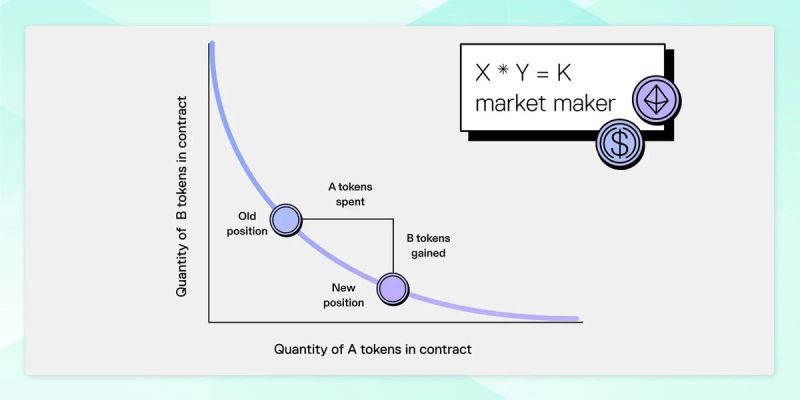

In this model, the price is set in such a way that the “constant product” formula for the pool is respected: X x Y = K

Where X = Reserve of the 1st token; Y = Reserve of the 2nd token; and K = constant

In this case, a curve represents liquidity, and different LPs are incentivised to provide liquidity because they earn trading fees when a swap is executed in the liquidity pool proportionate to their share of the pool's total liquidity.

Here’s a simplified example of how this works:

Let’s say you have $1,000 and want to provide liquidity to the BTC-USDC trading pair. This means that out of those $1,000, 50% will go into the BTC pool and 50% to the USDC pool. This action effectively contributes to the liquidity of the trading pair, enabling users to trade BTC for USDC and vice versa.

In return for providing liquidity to the pool, you receive LP tokens representing your share of ownership of this BTC-USDC liquidity pool. Then, as trade occurs on this pair, you, as an LP, earn a portion of these trading fees proportional to your share of the liquidity pool.

When you are done, you can withdraw your funds from the pools. However, it is important to keep in mind that withdrawing funds might incur impermanent losses if the relative prices of the assets in the pool have changed since you initially provided liquidity. But that’s the subject of another piece. For the sake of this paper, those simplifications are more than enough for what follows.

What does all of this have in mind with our Alpha Opportunity? Let’s see.

Bridging the best of both worlds with a new Alpha Opportunity structure

As discussed, in a classic VC-style investment, VCs usually settle a deal where they agree to buy tokens from a project that needs funds to grow. As the project is generally in its early stages of development with no certainty about its future, they can secure an attractive valuation before the token TGE (Token Generation Event). As part of the deal, VCs usually have strict token vesting rules with specific lock-up and distribution periods to align the long-term incentives with the project.

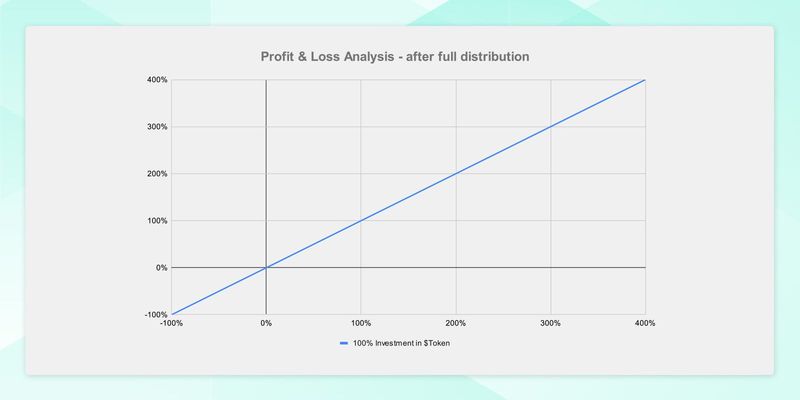

This is the payoff of VCs after the full distribution period:

We note that the payoff here is linear:

- If successful, they can earn a multiple of their initial investment. For instance, if the token price has doubled from their deal price, they earn a 100% return on investment.

- But losses also work in the same way. This means that if the token sits at a 50% discount from the deal price, VCs will incur a 50% loss on their investment.

A step further

Now, with this new Alpha Opportunity design, instead of only buying tokens at favourable price conditions and with a given vesting schedule (like VCs), we are going to become market-makers for the project token and also receive an incentive reward program in token over the period that liquidity is locked.

In that way, this Alpha structure allows investors to capture the best of both worlds.

A theoretical deal could look like this:

Step 1: SwissBorg raises $1 million for a new Alpha Opportunity.

Step 2: The $1 million is then split in a liquidity pool, where 50% goes into USDC and 50% goes into the new token.

Step 3: This liquidity pool is then locked for a set amount of time, and trading fees are distributed to Alpha participants according to a schedule.

Step 4: The project tokens are also rewarded to investors as an incentive program.

Step 5: Finally, at the end of the liquidity pool lock-up, the two assets are withdrawn from the pools, and whatever is left is distributed to Alpha participants.

Why is this an interesting structure?

The main benefit of this new Alpha structure for the project is that it supports a crucial task: market-making. This allows the project token to become more easily tradable from day 1. Hence, this deal structure is best suited for projects near their TGE and in need of a kickstart to push their project and token.

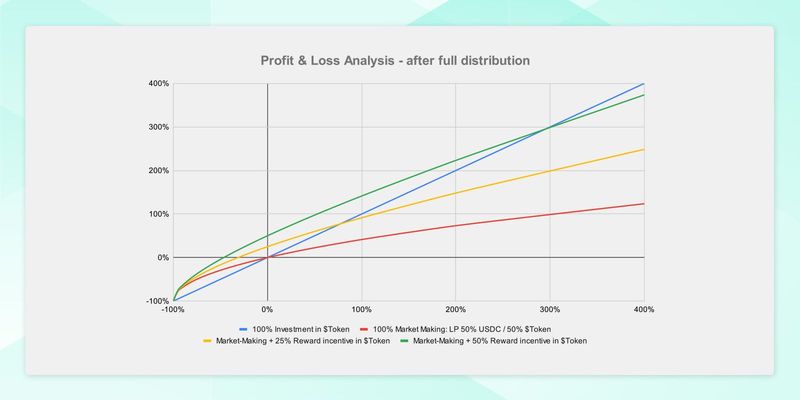

For Alpha investors, there are several benefits to this new Alpha structure. Let’s look at this by looking at a payoff matrix based on different token incentives reward for a $1,000 investment in $Token:

Here, the term “Reward incentive in $Token” implies that alongside the market-making, the project will also distribute token rewards equating to “x%” (subject to the deal intricacies) of the investment amount at TGE valuation. For instance, a 50% Reward incentive $token means that the project will distribute 50% of the investment amount, at TGE valuation, as a reward to market-makers.

This is the Profit & Loss structure of this deal under different kinds of token incentive programs:

We note that this kind of deal allows for:

- Downside protection: One of the main benefits of this new Alpha structure is that it offers much better downside protection. Compared to traditional 100% token deals, we note that the losses are smaller. To illustrate this, we see from the graph below that if, at the end of the lock-up period, the token is 50% below the deal price, a 100% Market-making deal will only experience a drawdown of approximately 29% (compared to a 50% loss for a 100% VC-like deal).

- Token incentives: Under a 100% market-making structure, the upside potential is more capped than a classic VC-type deal. To compensate for that, projects will offer a reward of its tokens to investors. This incentive program aims to ensure that the terms of the deal provide an upside potential that is as good, or even better, than if it were conducted in a classic VC-style manner. Again, from the graph below, we see that for a 200% price performance, a market-making deal with a 50% token reward leads to a profit of $2,323 against $2,000 if it were conducted as a classic VC deal. However, the payoff of the market-makers is slightly concave, which means that for a high return on investment, a linear payoff is best suited.

- Trading fees generation: Alongside that, Alpha participants will be able to earn part of the trading fees generated by the liquidity pool. This is an additional source of rewards. However, this reward is not fixed as it will depend on the trading volume generated by the pool (this reward has been omitted in the previous table for simplicity).

Innovating together: placing community at the heart of progress

With this new chapter of “Better than CEX,” we are happy to introduce you to a new type of Alpha Opportunity and give you even more power. More than a VC, this structure allows you to invest like a market maker to secure attractive deal terms and get the best of both worlds.

We are continuously seeking ways to democratise access to wealth management and investment opportunities. Merging the principles of classic VC investment and market-making shows our commitment to levelling the playing field for all investors. By bridging the gap between traditional venture capital investment and the dynamic world of market-making, we aren’t just providing an avenue for investment but reshaping the fabric of crypto finance.

As we embark on this next chapter, SwissBorg is more than just a platform; it's a movement towards a more equitable financial future. By enabling our users to act as both investors and market-makers, we're not only enhancing their potential for profit but also contributing to the liquidity and stability of the crypto markets. This dual approach highlights our belief in the power of innovation to create opportunities for everyone, regardless of their background or financial status.

I hope you are ready for what’s coming next.

Because it is truly better than CEX!

Disclaimer: The information contained in or provided from or through this article (the "Article") is not intended to be and does not constitute financial advice, trading advice, or any other type of advice, and should not be interpreted or understood as any form of promotion, recommendation, inducement, offer or invitation to (i) buy or sell any product, (ii) carry out transactions, or (iii) engage in any other legal transaction. This article should be considered as marketing material and not as the result of financial research/independent investments.

Neither SBorg SA nor its affiliates (“Entities”) make any representation or warranty or guarantee as to the completeness, accuracy, timeliness or suitability of any information contained within any part of the Article, nor to it being free from error. The Entities reserve the right to change any information contained in this Article without restriction or notice. The Entities do not accept any liability (whether in contract, tort or otherwise howsoever and whether or not they have been negligent) for any loss or damage (including, without limitation, loss of profit), which may arise directly or indirectly from use of or reliance on such information and/or from the Article.

Discover our upcoming Alpha opportunities today