At SwissBorg, we want to empower everyone on their journey to financial freedom. One way to make this vision a reality is by giving our community access to exclusive investment opportunities with the same or even better terms as professional investors. This is why we have carefully crafted our alpha opportunities to allow our community to invest in early-stage projects in the same way that VCs secure their deals. Because let’s face it, in crypto, the highest rewards are found in the private sphere, and we want to ensure that our community has access to that.

High-risk, high rewards

But as the saying goes,“on ne peut pas avoir le beurre et l’argent du beurre”. So if you want to play the same game as early-stage investors, you also need to accept the inherent risks. The harsh reality is that getting access to promising early-stage projects does not guarantee a return. It often works a bit in the opposite way: the earlier you invest in a project, the higher the potential rewards, but the greater the risk as well.

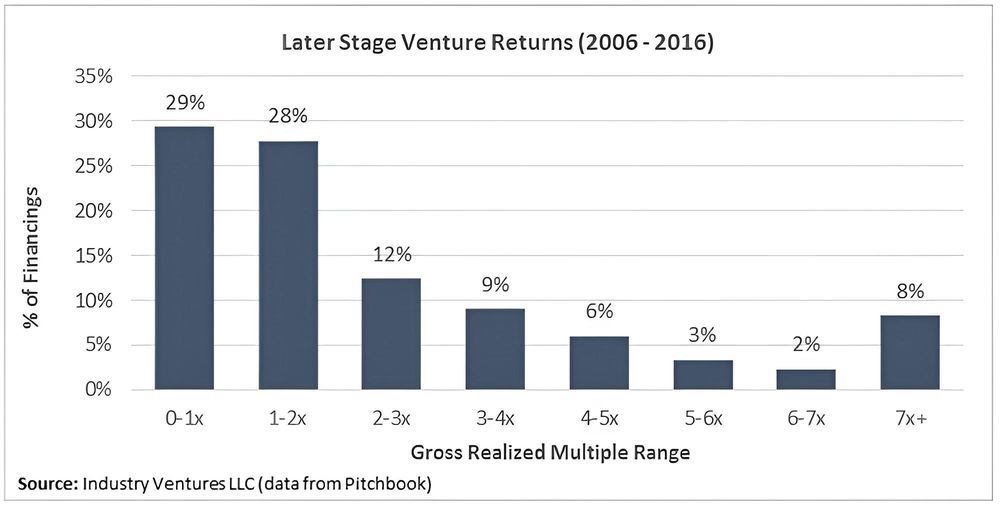

The typical “successful” venture portfolio is often described as having the following outcome:

- 1/3 of investments fail

- 1 /3 of investments break even or make a small amount of money

- 1/ 3 of investments do well and are responsible for most of the portfolio returns

Source : industry ventures

This is a generalisation, but one that is widely accepted and makes the point that venture investing is typically characterised by a skewed return profile: a high failure rate and a handful of investments that drive the bulk of the returns. In the words of Peter Thiel, a legend in the venture space, “the biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.”

This is a key point to keep in mind when approaching our Alpha Deals as it comes with an inherent element of risk associated with early-stage investing. Again, as stated earlier, “you can't have the cake and eat it too.”

Project selection

Since the beginning of this Alpha journey, our objective at SwissBorg has been to select projects that we believe have the potential to fall on the right side of the distribution chart. That’s why we implemented a rigorous investment due diligence process, analysing all the metrics we deem important to decide whether a project should participate in the alpha deals.

Curious about our Alpha Deals? Visit our dedicated Alpha page!

This approach has led us to select various projects for our alpha deals:

XBorg

XBorg is a first-of-its-kind gaming credential and application network that aims to take over the GameFi industry by storm. This project was a direct bet on the broader success of GameFi by getting exposed, not to a single game, but to the gaming protocol that could empower this revolution.

Learn more about XBorg: https://academy.swissborg.com/en/learn/what-is-xborg

Phaver

Phaver is a Web3 social media platform powered by social graph protocols Lens Protocol and CyberConnect. The goal behind this project is simple: deliver the most relevant feed for each user through incentivised curation and digital reputation while maintaining privacy and ownership.

Learn more about Phaver: https://swissborg.com/blog/deep-dive-into-phaver-the-gateway-to-web3-social

GoGoPool

GoGoPool is a permissionless staking protocol on Avalanche combining liquid staking, decentralisation hardware, and subnet compatibility. For us, Gogopool was an investment opportunity that aims to capture the nascent and growing liquid staking trend on Avalanche.

Learn more about GoGoPool: https://academy.swissborg.com/en/learn/alpha-opportunity-understanding-gogopool-investment

Creta

Creta is not just one specific product; it is an entire web3 gaming ecosystem that integrates various elements such as a gaming storefront, platform, creation tools, asset marketplace, and metaverse development, encompassing a wide array of gaming experiences. The two main assets behind Creta are, first, its broad intellectual property base with franchises such as "Kingdom Under Fire" and "Fortress." Additionally, the team behind the project is strong, with deep experience in gaming.

Learn more about Creta: https://academy.swissborg.com/en/learn/alpha-opportunity-creta-investment-future-of-web3-gaming

Colony Lab

Colony Lab is the first community-driven funding platform designed for the Avalanche ecosystem. Their mission is twofold: to help early-stage projects build on Avalanche, and to deliver attractive seed investment opportunities for its community. In a sense, Colony Lab's success is directly related to the success of the Avalanche ecosystem as a whole.

Learn more about Colony Lab: https://academy.swissborg.com/en/learn/colony-lab-investment-opportunity-avalanche

ChronoForge

ChronoForge is a free-to-play multiplayer RPG (Role-Playing Game) Web3 game with an MMO-scale (Massively Multiplayer Online) social experiment that gives real consequences to collective player decisions. It also features AI character generation for unique personas and gameplay scenarios. We liked ChronoForge because of its unique and innovative game scenario, leveraging AI to create unique gameplay, as well as its strong backers and team.

Learn more about ChronoForge: https://academy.swissborg.com/en/learn/chronoforge-investment-opportunity-gaming-ai

Stader Labs

Stader Labs is one of the frontrunners of liquid staking thanks to their development of solutions that enhance both the security and the accessibility of liquid staking. Their work simplifies participation in the staking economy for both delegators and validators alike.

Aethir

Aethir is a decentralised computing infrastructure network that aims to connect underutilised GPU supply with users that need GPU computing, using a novel approach to cloud computing infrastructure, focusing on the ownership, distribution, and usage of enterprise-level GPUs. One of the biggest catalysts for Aethir as it offers direct exposure to invest in GPUs which are the main driver of the current AI revolution taking place.

Learn more about Aethir: https://academy.swissborg.com/en/learn/alpha-opportunity-become-aethir-validator-node

VictoriaVR

Victoria VR is a comprehensive Virtual Reality platform. It is a blockchain-based MMORPG (Massive Multiplayer Online Role-Playing Game) in Virtual Reality with realistic graphics built on Unreal Engine, co-created and owned by its users. We saw this project as a way to be exposed to the VR/AR (Virtual reality/Augmented reality) trend.

Learn more about VictoriaVR: https://academy.swissborg.com/en/learn/alpha-opportunity-victoria-vr-metaverse

Agora

The mission of Agora is simple: connect the most promising GameFi project with gamers and investors worldwide and push the adoption curve of blockchain gaming a step further. We believe that the next generation of Web 3.0 games will be driven by real gamers, real experiences, and real infrastructure that welcome the next generation of gamers on the blockchain. For this vision to become a reality, we need projects that connect every stakeholder in a single hub and this is why we liked Agora.

Learn more about Agora: https://academy.swissborg.com/en/learn/agora-alpha-deal

Dark Machine

Dark Machine is a mech-based esports 7v7 arena-shooter-style game built on Unreal Engine 5. As such, it can be thought of as a unique blend of Transformers and Halo. But over and above, Dark Machine is also a cross-media IP, collaborating with legends in the Japanese anime space to produce global media for broadcast and streaming.

Learn more about Dark Machine: https://academy.swissborg.com/en/learn/dark-machine-alpha-opportunity-in-web3-gaming

Carv Protocol

CARV Protocol is a modular data layer that facilitates data exchange and value distribution, mainly across gaming and AI. This protocol encompasses the entire data lifecycle process and enables users to own, control, verify, and monetise their data fully. This represents a game changer from the current corporate network models where users' data are misused, unsecured and out of the control of users and this is why we believed Carv had a lot of potential.

Learn more about Carv: https://academy.swissborg.com/en/learn/carv-verifier-node-gaming-ai

Galactica Network

Galactica Network is a pioneering L1 blockchain designed to blend the ethos of Cyberpunk and the global regulatory standards. Just like Bitcoin was for money and Ethereum for Finance, Galactica is building the Web3 identity stack, the ultimate use case for data in public blockchains.

Learn more about Galactica: https://drive.google.com/drive/folders/1vYw60WRdYBAmMSRii7zeozfmJ9s5A8L6

WeatherXM

WeatherXM is a DePIN (Decentralised Physical Infrastructure) project that aims to build an entirely new weather data economy by leveraging the value proposition of crypto to become the most comprehensive and accurate weather network available. We saw WeatherXM as a project with a lot of potential ahead as well as a way to have a positive impact on the world by helping everyone get access to reliable weather forecasting.

Learn more about WeatherXM: https://academy.swissborg.com/en/learn/weatherxm-alpha-opportunity

Performance up to date

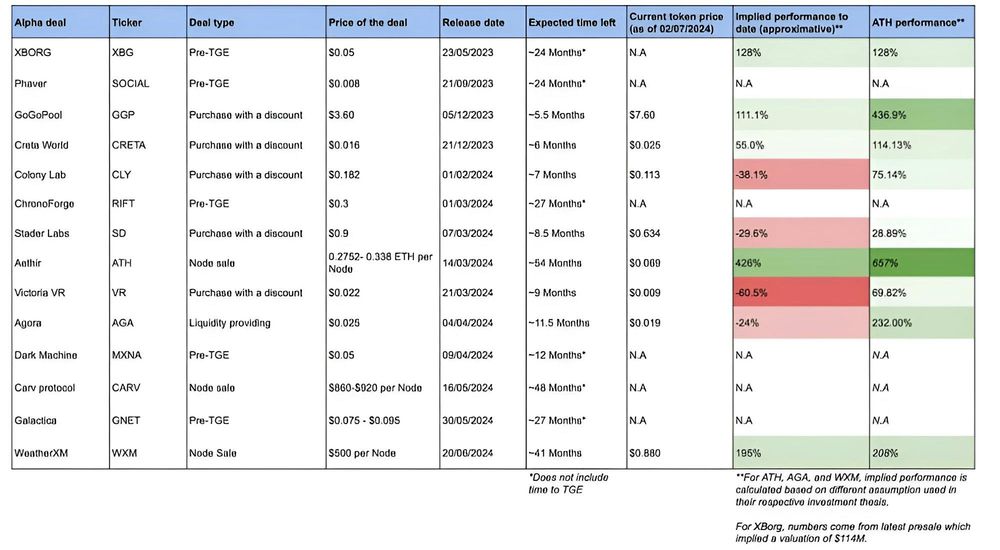

This is the performance of all our alpha deals to date:

It is important to understand that not all deals are liquid yet, as some have not had their Token Generation Event (TGE), and therefore we cannot compute their implied returns. Further, to calculate the implied returns of Aethir, Agora, and WeatherXM, we relied on different assumptions found in their respective investment theses. For XBorg, we used numbers from their last presale, which implied a valuation of $114 million.

If we consider only liquid deals, we observe that our best deal to date was Aethir. At launch, this project generated a lot of buzz and we believe it still has a lot of room to grow. On the other hand, our worst performer was VictoriaVR which experienced disappointing price actions and followed the overall downtrend of the altcoin market over the past months. We expect this project to continue to be influenced by the general market sentiment, and if there is an alt season, we think this project could see growth.

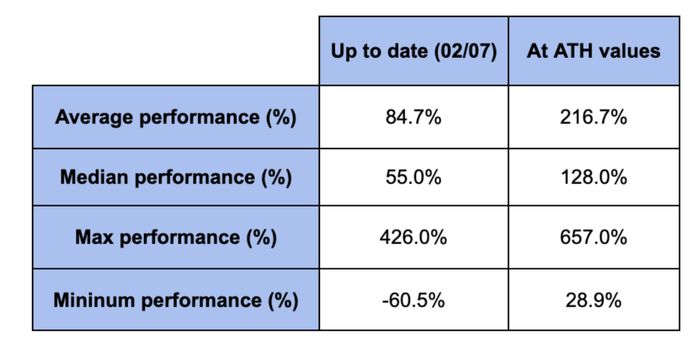

Here are some statistics on the performance of our liquid alpha deals:

Based on this, we note that an equal-weighted portfolio in every alpha deal would yield a performance to date of approximately 85% and a median performance of 55%. On the other hand, using ATH (All-Time High) values, the average performance rises to 217% with a median of 128%.

At SwissBorg, our mission is to democratise access to high-potential investment opportunities. Through our meticulously selected Alpha Deals, we've provided our community with the chance to invest in promising early-stage projects that are typically reserved for venture capitalists. The journey so far has been filled with both high rewards and inherent risks, underscoring the dynamic nature of the crypto market.

We love enabling the future and invite you to explore our latest Alpha Deals and see how you can be a part of the future of finance.